Top 6 benefits of an FHA loan

FHA loans are designed to help those with less-than-perfect credit. Borrowers can often qualify with a credit score as low as 580, though some lenders may approve applicants with scores as low as 500 if they can make a larger down payment.

Potential homebuyers looking for lower MI costs for FHA loans got a pleasant surprise early in the year, as annual FHA loan Insurance Premiums were lowered for the first time in eight years.

Discover the pros and cons of obtaining a home loan in our comprehensive guide.Learn how home loans in Anaheim, California can build equity, offer tax benefits and more while also considering the potential downsides like interest costs and foreclosure risks. Make an informed decision about homeownership.

Rising home prices and pretty solid loan performance over time helped the capital strength of the FHA’s Mutual Mortgage Insurance Fund (MMIF) to rise to record levels recently. FHA’s self-insurance pool is mandated to have a minimum reserve of 2% against losses, and this percentage rose to 11.11% in the 2022 fiscal year. Although it has settled back a little lately, the MMIF reserve ratio closed 2023 fiscal year at 10.51%, still more and five times the required amount.

Strong capital levels over the last couple of years led to increasing calls for the FHA to lower costs and 2024 is no different. While the last push was to lower recurring costs for homebuyers and homeowners, the most recent industry pressure is for the FHA to drop its life-of-loan mortgage insurance requirement for borrowers whose loans begin with less than a 10% down payment. Currently, borrowers must refinance out of the FHA program to be able to cancel their mortgage insurance, provided their loan’s LTV ratio has fallen below 80%.

Discover 5 effective strategies to lower your home loan EMIs in California. Learn how to make your mortgage more affordable with tips on loan tenure, down payments, refinancing, extra payments, and lender negotiations. Start saving today!

Since the most recent cut to annual MIP costs was just a year ago, there’s little chance that another MIP cut will come. As well, as most borrowers finance the upfront mortgage insurance premium (UFMIP) into their loan, there’s little upfront savings from reducing this component, either. That leaves a change to allow a cancellation of MIP a possibility to help lower the cost of homeownership, but this probably doesn’t produce a huge or immediate benefit for homeowners.

HSH.com – FHA MMIF Capitalization Ratio 1999-2023Lower costs may see some borrowers more likely to consider an FHA-backed loan. At the same time, it’s likely that access to FHA funding will improve a bit more this year; given slow housing markets and little refinancing activity, lenders are eager to find borrowers to serve. To do so, it’s reasonable to think that at least some lenders will slowly reduce or remove so-called “overlays”, where a lender requires a higher credit score than the minimums that the FHA allows. Borrowers with less-than-stellar credit should shop around to find these more aggressive lenders.

Newly-lower recurring mortgage insurance costs are certainly attractive, but FHA loans offer other valuable features, too. Add lower down payment and credit-score requirements into the mix, then factor in that the FHA doesn’t use risk-based pricing to set rates — so borrowers aren’t penalized for having weaker credit scores — and FHA mortgages can be an attractive option to many borrowers. As an added bonus, these federally-insured loans are assumable, so if mortgage rates should rise from here and hold there for a time, a lower-rate FHA mortgage can be passed along to the next homeowner when it comes time to sell.

With housing markets softening up considerably in 2023 and into 2024, home sellers may be more accepting of borrowers using FHA-backed loans to buy homes. FHA-backed loans carry more stringent contingencies than do conforming loans, and can require more effort on the part of the home seller to complete the transaction. When it’s a full-blown sellers market, as it has been in recent year, some sellers won’t consider offers that require FHA approval.

Discover how bank statement loans can help you secure a mortgage without traditional income documentation. Ideal for self-employed individuals and freelancers, these loans use bank statements to verify income, making homeownership more accessible. Learn more today!

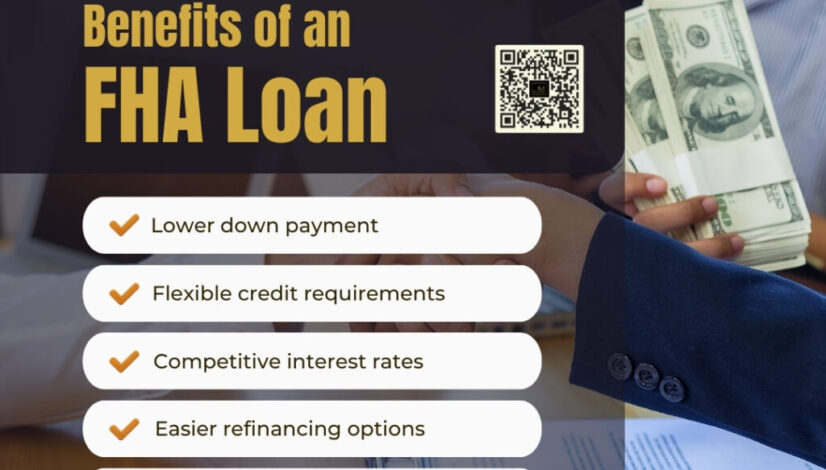

Here are the advantages of FHA mortgages:

Lower credit score and down payment requirements

The FHA requirements for credit score and down payments are far lower than for conventional loans. Borrowers can technically qualify for an FHA loan with credit scores of at least 580 and a down payment of just 3.5 percent, according to HUD. Borrowers with a 10% down payment may be eligible with a FICO score as low as 500.

”While an FHA-backed mortgage with FICO 580 is theoretically available to borrowers, many lenders add ‘overlays’ on these minimum requirements,” says Keith Gumbinger, vice president of HSH.com. “Loans with the lowest credit scores tend to default at a much higher rate, and lenders are afraid that if they issue too many loans that later fail, HUD will no longer allow them to write FHA-backed mortgages.”

The evolution of FHA mortgage rates

FHA mortgage rates

FHA mortgage rates are typically lower than mortgage rates on conforming loans. FHA Borrowers with credit scores of 660 will often qualify for the same interest rate as would conventional borrowers with a score of 740, says Blair-Gamblian.

One important difference between conforming and FHA mortgages is that unlike conventional mortgages, FHA does not use a risk-based pricing arrangement. This means that borrowers who don’t have the best credit aren’t penalized with a higher interest rate, and that can be a strong reason to consider an FHA-backed loan, even if there can be drawbacks on the mortgage insurance side, discussed below.

Learn about FHA borrower requirements

Closing costs

FHA loans allow sellers to pay up to 6 percent of the loan amount to cover buyers’ closing costs, says Tim Pascarella, assistant vice president with Ross Mortgage Corporation in Royal Oak, Michigan. In conventional loans, sellers can only pay up to 3 percent.

“For a lot of homebuyers, that’s a big benefit,” says Pascarella. “A lot of buyers, especially first-time buyers, can save enough money for a down payment, but then they have nothing else. An FHA loan allows sellers to contribute more to closing costs.”

FHA loans are assumable

FHA borrowers have yet another advantage over conventional borrowers: FHA loans are assumable. When it comes time to sell, buyers can take over sellers’ existing FHA loans instead of taking out new mortgages at whatever the current mortgage rate is at the time. This is especially advantageous in a rising-rate environment.

Assuming an FHA loan isn’t always simple, though. While buyers will have to meet all the typical mortgage requirements, they may need a much larger down payment depending on the seller’s equity.

Learn all about FHA ARMs

FHA allows “Streamlined Refinances”

Unlike most of the conventional and conforming mortgage markets, the FHA program allows a borrower to do a true streamlined refinance. For a 30-year fixed-rate loan, this means only needing to reduce your “combined” interest rate (the loan’s contract rate plus MIP premium rate) by 0.5%. but there may be no credit check, no appraisal of the property and no income or employment verification required. This could allow you to save money if mortgage rates should fall, and there is no limit on the number of times you can use this benefit, provided it produces what HUD calls a “net tangible benefit” to you.

FHA mortgage insurance premiums

The biggest downside of FHA loans has long been the costs associated with the upfront and annual mortgage insurance premiums. The 2023 change to MIP costs has helped change that.

The upfront mortgage insurance premium is 1.75 percent of the loan amount. That’s $5,250 on a $300,000 mortgage loan. Although you can pay it out-of-pocket, this cost is usually added to the principal balance of your loan. So your loan amount is actually $305,250.

FHA mortgage insurance for the life of the loan

With conventional mortgage loans, borrowers don’t have to pay for private mortgage insurance if they come up with a 20 percent down payment. Conventional borrowers can even request that private mortgage insurance be dropped once their mortgage balance falls to 80 percent of the value of their home.